The Buzz on How To Form An Llc In Georgia

To make sure the availability of the name you want for your LLC, whether it's registered as your DBA name or not, you need to conduct an LLC name search on your development state's website to determine whether your preferred name is available. If you're not all set to file your LLC development file rather yet, it is a great idea to schedule the name.

It's likewise a great concept to conduct a trademark search of the name you wish to avoid intellectual home violation or confusing your clients. Step 3: Select a Registered Agent In forming an LLC or signing up an existing LLC to transact service in a foreign state, you are required to have actually a signed up representative in the state of formation or qualification.

A signed up agent, likewise referred to as a representative for service of process, receives essential legal notifications and tax files on behalf of an LLC. These include essential legal files, notifications, and interactions mailed by the Secretary of State (such as annual reports or statements) and tax documents sent out by the state's department of tax.

Other court files such as garnishment orders and subpoenas are likewise served on the signed up agent. While the owner of an LLC can choose to act as the LLC's registered representative, there are a variety of compelling reasons company ownerseven the smallest oneschoose a signed up representative service supplier to help with this important requirement.

About How To Form An Llc In Georgia

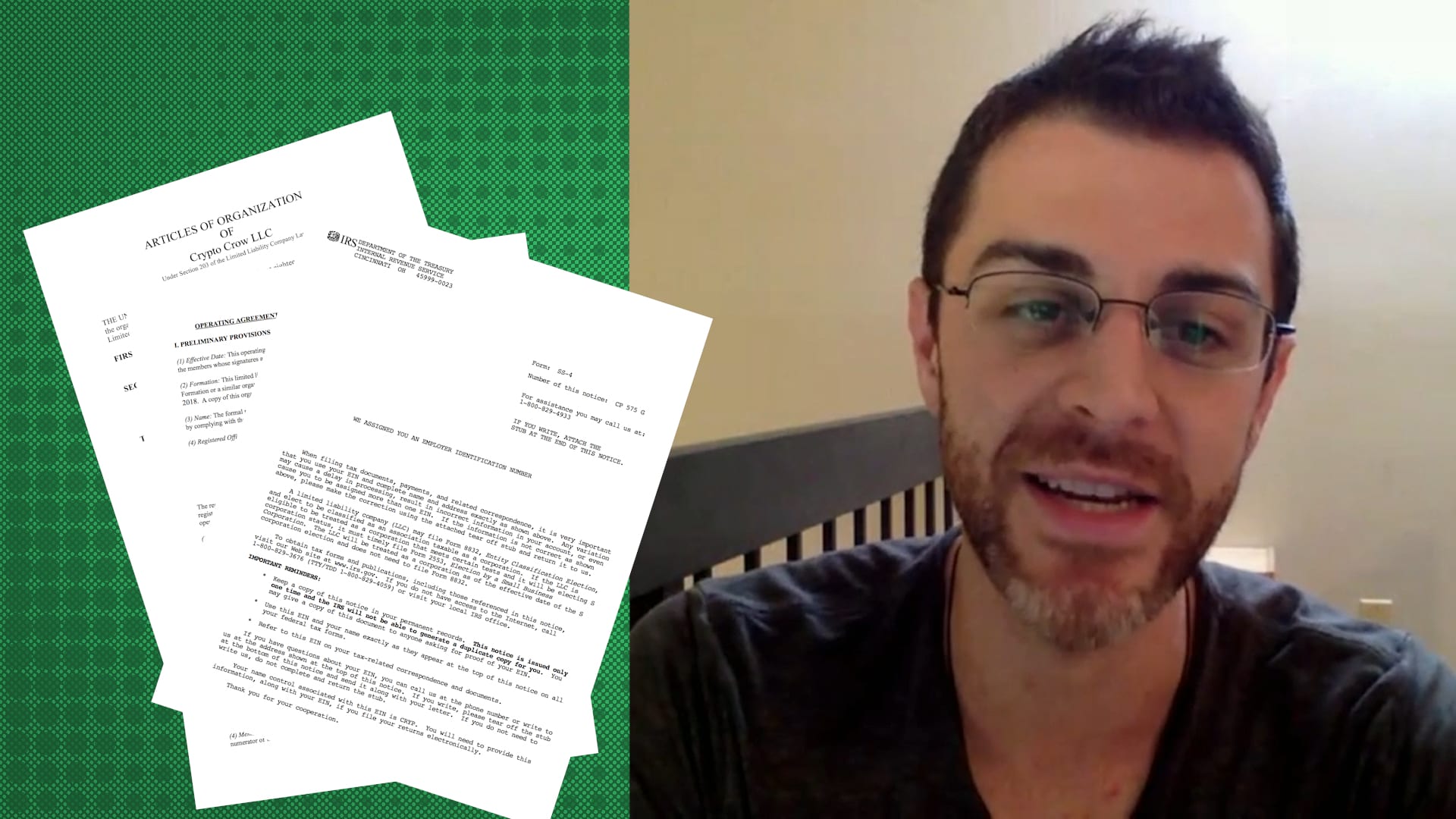

The signed up representative should also have a physical address in the state, and can not utilize a PO Box. Step 4: Prepare an LLC Operating Contract An LLC operating arrangement is needed in almost every state. And although in many states it can be oral, it is highly suggested that every LLC have actually a written operating arrangement.

Even if you are the only member it is necessary to have an operating contract. It shows you respect the LLC's separate existence (and can help avoid piercing the veil), it provides you a chance to put in composing what you wish to take place in certain scenarios such as if you can no longer handle business, and allows you to pull out of certain default provisions of the LLC statute that you may not desire the LLC to be governed by.

This document will clearly define the division of ownership, labor and earnings, and often avoids conflicts among the owners. It should information, amongst things, who has authority to do what, what vote is needed to authorize certain transactions, how subscription interests can be transferred, how brand-new members can be included, how distributions, earnings and losses will be split, and more.

Check out more about the problems an operating agreement can resolve. Step 5: Submit Your LLC with Your State To make your brand-new LLC officially exist you should file LLC development documents (also referred to as a Certificate of Company, Certificate of Formation, or Articles of Company) with the Secretary of State's workplace or whichever department deals with business filings in the state in which you are forming.

Fascination About Starting A Business In Oregon

" Incorporation" and "Articles of Incorporation" are terms that use to a corporation (despite whether it is taxed as a C corporation or S corporation). While each state's LLC formation file is various to some level, there are several typical aspects. These include the following: Call, primary location and function of business Registered agent's name and physical address Whether the LLC will be member-managed or manager-managed Standard forms for the short articles of company for an LLC are generally available from each state.

For the most part that does not have to be a member or manager. In some states, the signed up agent's grant image source function as registered agent is likewise required. As soon as authorized and submitted, the state will provide a certificate or other confirmation document. The certificate functions as legal evidence of the LLC's status and can be utilized to open a company bank account, acquire an EIN, and so on.

This is the recognition number your LLC will utilize on all its checking account, in addition to income and work tax filings. In addition, in each state in which the LLC will be doing service, you must apply to the state's tax department for a sales tax recognition number and register with the state's labor department.

It is important to separate company finances from individual ones. This is among the main factors courts think about when choosing whether to pierce an LLC's veil and hold the member accountable for the LLC's debts. Most banks need company details, such as development date, business type, and owner names and addresses.

How To Form An Llc In Georgia - Truths

Step 8: Register to Do Company in Other States (If Essential) If the LLC you formed is going to be doing business in more than just the formation state, you will need to registeror foreign qualifyin each "foreign" state. That generally needs filing an application for authority with the Secretary of State.